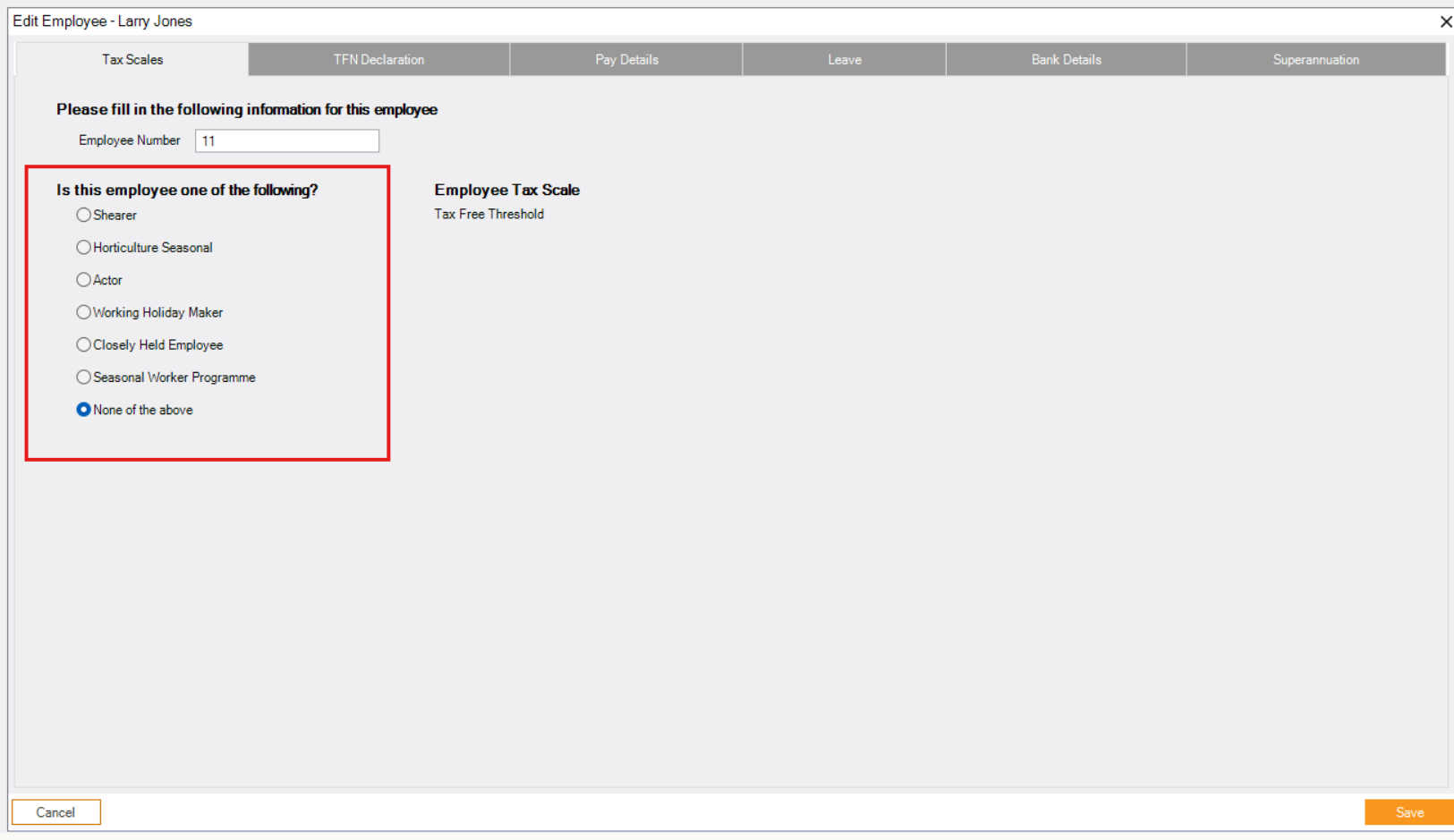

Setting Income Types for STP2

STP2 requires an Income Type Code to determine if an employee is categorised as:

- Salary and Wages

- Working Holiday Maker

- Seasonal Worker Programme

- Closely Held Employee

- Selecting ‘Shearer’, ‘Horticulture Seasonal’, ‘Actor’, and ‘None of the Above’ will result in the Income Type being set to Salary and Wages (SAW).

- Selecting ‘Closely Held Employees’ will result in the Income Type being set to Closely Held Payees (CHP).

- Selecting ‘Seasonal Worker Programme’ will result in the Income Type being set to Seasonal Worker Programme (SWP). This means they will be taxed at a flat rate of 15%.

- Selecting ‘Working Holiday Maker’ will result in the Income Type being set to Working Holiday Makers (WHM).

Related Articles

Deleting and Reprocessing Pays to Send as New in STP

Please note: only follow the steps listed below if you have been advised by customer support. To check if you should be doing this process, you can either email support at info@cashflow-manager.com , do a live webchat, or call on 08 8275 2000 and ...Country Codes and Working Holiday Makers in STP2

If an employee is categorised as a ‘Working Holiday Maker’, STP2 requires a Country Code. The Country Code is essentially the employee’s country of origin. When setting up an employee as a working holiday maker, it is now an ATO requirement to add in ...Deleting Old Pays from the STP Event Lodgement Screen

Continue if you have previous pays listed in the Single Touch Payroll screen that you do not want to send. From the [Tools] menu or on the right-hand side of the Employees screen in wages, select [Single Touch Payroll] to open the Single Touch ...Wages Manager Basics

Wages Manager Wages Manager simplifies payroll by assisting employers with calculating wages, leave, tax, termination pays and superannuation. Single Touch Payroll and SuperStream is also available within Cashflow Manager Gold, Wages Manager and ...Deleting Old Pays from the STP Event Lodgement Screen

If you have previous pays listed in the Single Touch Payroll screen that you do not want to send, you first need to clear them from the form. From the [Tools] menu or on the right-hand side of the Employees screen in wages, select [Single Touch ...

Popular Articles

Starting a New Financial Year in Wages

You can start a new financial year by following the below steps: 1. In the Employees section of Wages, select [Tools] in the top left 2. Select [Financial Year] 3. Select [Start New Financial Year] 4. The financial year ending will read 202X, select ...Software Subscription Pricing - Australia

The Cashflow Manager Subscription model is monthly or yearly based. Please find below the pricing model: Cashflow Manager - $27/month or $295/yearly Cashflow Manager GOLD - $49/month or $534/yearly Wages Manager - $37/month or $398/yearly Wages 1-4 - ...Converting your Version 12 business file to Version 14

Summary If you're updating from Version 12 to Version 14, you will need to convert your business file to the new format. Fortunately, this is easily done by first creating a new back-up of your Version 12 Business File, then converting it to the new ...Completing your EOFY payroll

Finalising your year-end payroll It's important to note the final pay period for the financial year is the one that is PAID before the end of the financial year. The first pay period of the next financial year is the first one that is PAID during the ...How Do I Email From Cashflow Manager?

How do I email from Cashflow Manager? Cashflow Manager offers two main ways to send emails via the program: Sending through your desktop email program (e.g. Outlook) Sending through your web email client To get started, open up your business in ...